Knowledge Portal: Managing Business Finances and more

CHRIS BARNARD December 16, 2024

Drive Down Your Taxes: Smart Tips for Entrepreneurs & Business Owners on Car and Van Expenses

Explore Vehicle Selection for Optimal Tax Savings

If you're keen on optimising business costs and maximising tax savings, whilst being well informed about car and van expenses for businesses this blog is for you. We delve into how selecting the right cars and vans can utilise business vehicle tax deductions to significantly reduce those hefty bills.

Understanding Business Vehicle Tax Deductions

Let’s simplify vehicle expenses and tax deductions. Whether you're driving a compact car or operating a van, many associated costs can be deducted from your taxable income, decreasing your tax liability. In the UK, these deductions vary based on whether you buy, lease, or use your personal vehicle for business purposes.

Buying vs leasing for tax savings: Tax Efficiency for Your Limited Company

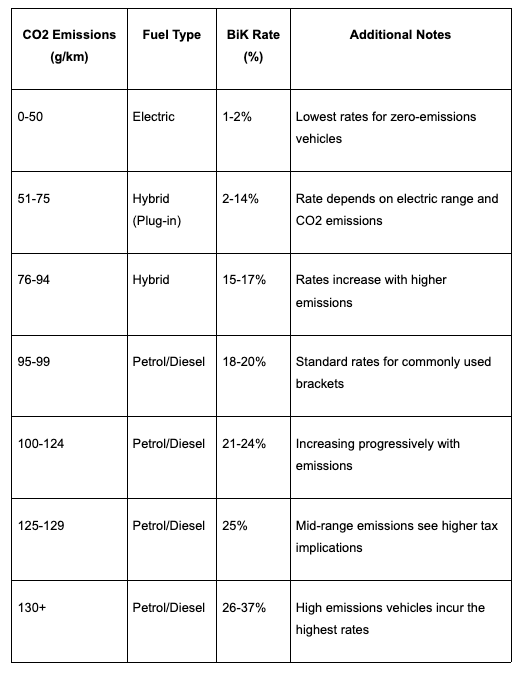

When choosing between buying or leasing for your company, it's crucial to consider the tax implications. Both options incur Benefit in Kind (BiK) taxes, which are taxes on non-cash benefits like company cars. These are taxed because they count as extra compensation beyond the salary. The BiK rate depends on the car’s value, CO2 emissions, and fuel type. The following rates apply to vehicles registered after April 6, 2021.

As announced at Autumn Budget 2024, the appropriate percentage used to calculate an individual’s company car tax for zero emission vehicles will increase for 2028 to 2029 and 2029 to 2030 by 2 percentage points per year.

The appropriate percentage rates for vehicles which produce 1g to 50g CO2 per kilometre and are also capable of operating on electric power within a certain range will be amended. Vehicles with CO2 emissions of 1g to 50g per kilometre will have appropriate percentages of 18% in 2028 to 2029 and 19% 2029 to 2030.

The appropriate percentages for all other emission bands will increase by 1 percentage points per year in 2028 to 2029 and 2029 to 2030. This will be to a maximum appropriate percentage of 38% for 2028 to 2029 and 39% for 2029 to 2030. Click here to view a table detailing the increases.

Please note that a 4% surcharge applies to diesel vehicles not meeting the RDE2 standard.

Table 1

The table demonstrates the different factors that influence BiK rates. For anyone managing a fleet or considering a company car, it’s important to stay updated with the latest tax rates as they can significantly impact financial decisions.

For employees, the BiK value boosts their taxable income for the year. For employers, it means paying Class 1A National Insurance contributions based on the total BiK value, which are calculated via the P11D form. This form, required by HM Revenue & Customs (HMRC), details the cash value of benefits provided, helping assess due National Insurance contributions and ensuring accurate tax payments by employees.

This streamlined approach retains key information while reducing the overall length, focusing on the essential aspects of vehicle choice impacts on taxes for businesses.

Understanding Capital Allowances for Business Vehicles

Understanding the tax implications when buying versus leasing a vehicle is crucial for any business. Capital allowances can significantly affect your tax calculations.

Capital Allowances on Purchased Vehicles

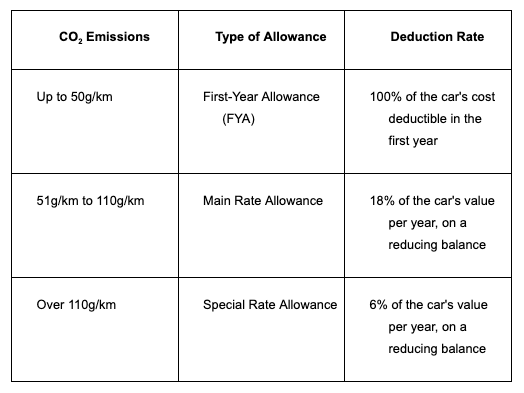

When you buy a car for business use, you can claim capital allowances, allowing you to deduct a portion of the vehicle's value from your profits before tax. The deduction rate depends on the car’s CO2 emissions:

Table 2

Leasing Vehicles

The tax treatment for leased cars differs; you can generally deduct lease payments as a business expense against taxable.

Leasing Vehicles - Tax Advantages and Considerations

Leasing allows you to deduct hire costs as a business expense, appealing if you prefer newer models and frequent updates without the hassle of resale. However, if the car's emissions exceed 130g/km, only 85% of the lease costs are claimable.

Claim Business Travel Expenses with Your Company owned Vehicle

Business travel expenses include fuel, insurance, repairs, and maintenance, requiring precise record-keeping to distinguish between personal and business use as mandated by HMRC.

For Limited Company Directors and Employees Using Personal Vehicles

Directors and employees can use the Approved Mileage Allowance Payments (AMAP) for business travel:

- 45p per mile for the first 10,000 miles annually.

- 25p per mile thereafter.

- An extra 5p per mile can be claimed for each passenger on business trips, improving cost-efficiency.

For Self-Employed Individuals

Self-employed people have two different options. The first and simplest option is to claim AMAP. This is a better option where there is a lower purchase price on the vehicle. The second option is to claim Capital Allowances in the same way that they would for a company owned car. It’s possible to claim related actual expenditure and since there’s no company, there isn’t any Benefit in Kind.

Benefits of Vans and Pick-up Trucks for Business Use

Vans and pick-up trucks have traditionally benefited from being classified as 'plant and machinery' for tax purposes, allowing businesses to claim substantial tax relief under the Annual Investment Allowance. Until now, businesses could claim 100% of the cost in the first year.

Starting 1st April 2025 for Corporation Tax and 6th April 2025 for Income Tax, the classification for double-cab pick-up trucks with a payload of 1 tonne or more will change. These vehicles will be reclassified as cars, subjecting them to car capital allowance rules and higher Benefit-in-Kind (BIK) rates, reducing their tax benefits.

Transitional rules mean that vehicles bought, leased, or ordered before April 2025 will keep their current tax benefits until they are sold, the lease ends, or until 5th April 2029. Businesses should consider switching to fully commercial vehicles or electric vans to benefit from more favourable tax treatment.

For other types of vans not affected by these changes, the existing tax benefits will continue. Businesses should consult a tax advisor or refer to HMRC guidelines for detailed tax planning to effectively navigate these upcoming changes.

Staying Informed on Changes & Tax Advantages of Business Vehicles

Tax laws frequently change, mirroring shifts in market conditions and governmental priorities. For instance, the move towards environmentally friendly technologies has enhanced the tax benefits for electric and hybrid vehicles, such as lower Benefit in Kind (BiK) rates for company cars.

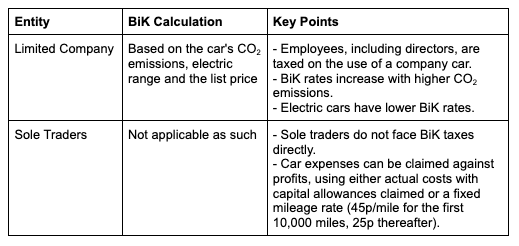

For limited companies, understanding and anticipating annual BiK rates, which vary based on a car's CO2 emissions and P11D value, is crucial. These rates significantly affect both the employee’s tax obligations and the employer’s National Insurance Contributions. (See Table 2 above)

Sole traders, on the other hand, don't contend with BiK. Instead, they can deduct car expenses directly from their profits. This method requires rigorous tracking of business versus personal mileage to comply with HMRC regulations, simplifying tax filing but emphasizing the need for precise record-keeping.

Staying abreast of these developments is vital for leveraging tax advantages and ensuring compliance in the ever-evolving landscape of business vehicle taxation.

Read more: Essential budget updates every business owner needs to know

Putting It All Together

Choosing the right vehicle for your business is crucial, not just in terms of make and model but also for understanding the tax implications of each option. Whether you buy, lease, or use your personal car for business, each choice impacts your tax situation and your bottom line.

We aim not just to share knowledge but to empower you to make the best financial choices. If you find the details of business vehicle tax deductions overwhelming, consider reaching out for personalized advice. Managing your business finances, especially in the complex world of taxes, can be much more manageable with expert guidance.

Whether you're a solo entrepreneur with a startup or a seasoned business owner with a fleet of vehicles, strategic decisions about your business vehicles can significantly reduce your tax expenses. Every penny saved is a penny that can be reinvested into growing your business.

If you have questions or need tailored advice, don't hesitate to get in touch. Let’s simplify tax planning and make your financial strategy more empowering. Here's to making informed decisions that enhance compliance and optimise your financial performance!

FAQs on Business Vehicle Tax

Can I claim tax relief on a company car?

Yes, you can claim capital allowances based on the car’s CO2 emissions. Low or zero-emission vehicles qualify for higher allowances, while high-emission models attract reduced rates. Electric cars often qualify for

100% First-Year Allowance, making them a tax-efficient option.

What’s the difference between buying and leasing a vehicle?

If you

buy, you can claim capital allowances over time. If you

lease, you can usually deduct the lease payments as business expenses, though the deduction may be restricted for higher-emission vehicles. The right choice depends on your cash flow and long-term plans.

Can I claim VAT back on a business vehicle?

You can reclaim VAT on vehicles used exclusively for business purposes. For cars with private use, VAT recovery is usually not allowed. However,

commercial vehicles, such as vans, typically qualify for full VAT recovery.

How is Benefit-in-Kind (BiK) tax calculated on company cars?

BiK is based on the car’s list price, CO2 emissions, and the type of fuel used. Electric vehicles currently attract a much lower BiK rate compared to petrol or diesel cars, offering significant tax savings for company directors and employees.

Are electric vehicles still tax-efficient for businesses?

Yes, electric vehicles remain one of the most tax-efficient choices for businesses. They benefit from lower BiK rates, zero road tax, and full capital allowances in the year of purchase.

Can Collective Concepts Accounting help me choose the most tax-efficient option?

Yes. we can help you assess whether buying, leasing, or switching to electric makes the most financial sense for your business, ensuring you maximise every available tax saving.