Knowledge Portal: Managing Business Finances and more

CHRIS BARNARD April 25, 2025

2025 Tax Tips for UK Landlords & Property Businesses

Introduction

Running a successful property business isn’t just about finding tenants or expanding your portfolio. It also means staying on top of your tax position. Whether you're a first-time investor or an experienced landlord, understanding the latest tax rules can help you protect your profits and avoid costly mistakes.

At Collective Concepts Accounting, we support landlords, investors, and developers across the UK in navigating everything from allowable expenses to VAT and Capital Gains Tax. With the right tax strategy, your property business can grow more efficiently.

In this post, we’re sharing four essential property tax tips for landlords to help you make smarter, more profitable decisions in 2025.

Tip 1: Know the Difference Between Capital and Revenue Expenditure

Accurately categorising your property expenses is essential for tax reporting and making the most of available deductions. As UK property accountants, we’re often asked about the difference between capital and revenue expenditure, and why it matters.

Revenue expenditure covers the everyday costs of running a rental property. These are typically recurring and fully deductible against your rental income. Examples include letting agent fees, insurance, repairs and maintenance, utility bills, and advertising for tenants.

Capital expenditure, however, relates to costs that improve the property’s value or extend its lifespan. These aren’t immediately deductible but can normally be claimed as capital allowances or used to reduce Capital Gains Tax when you sell. This includes structural renovations, extensions, and installing new kitchens or bathrooms. Residential rental businesses, however, cannot normally claim capital allowances.

The distinction isn’t always straightforward. For example, replacing old materials with modern equivalents (like copper pipes or steel girders) is usually classed as a repair — unless the upgrade enhances the property's capability, in which case it’s capital.

Even redecoration can become capital expenditure if it follows substantial improvement works and is integral to the upgrade.

For more clarity, speak to a property tax specialist. Understanding this difference can have a real impact on your taxable profit and help you avoid errors on your return.

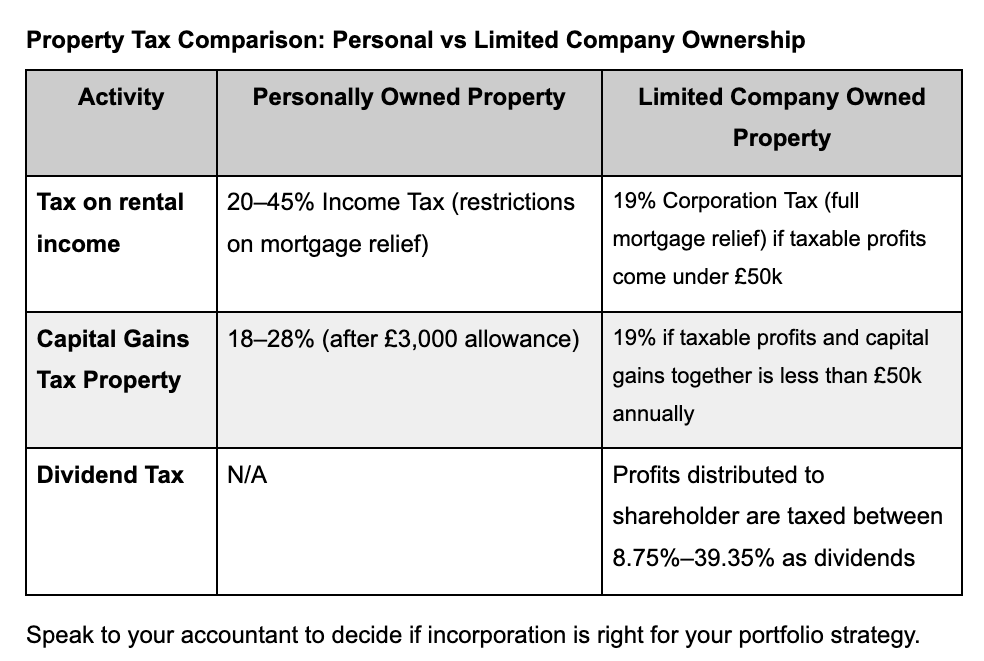

Tip 2: Should You Buy Property Through a Limited Company?

For landlords and investors looking to grow their portfolio, buying property through a limited company can offer tax benefits — but it’s not the right route for everyone. It’s important to weigh up the advantages alongside the added complexity.

Here are three key benefits:

Tax Efficiency

In contrast to personally owned property, full mortgage interest relief is available to claim on rental property.. Rental profits in a limited company are taxed up to 25% corporation tax rate — often lower than personal income tax for higher-rate taxpayers.

Financial Flexibility

Whilst profits can stay in the company to fund future purchases, pensions, or be paid out as dividends, it’s important to note that the dividends are taxed up to 39.35% on your personal tax return. If you’ve lent the company money (e.g. for a deposit), it can be repaid to you tax-free.

Inheritance Planning

Owning property through a company can offer estate planning advantages. Shares can be transferred instead of the property itself, potentially reducing Inheritance Tax, Capital Gains Tax, andStamp Duty.

That said, company ownership involves more admin, higher mortgage costs, and no CGT allowance when you sell so it’s not always the most cost-effective option. Speak to your accountant about UK landlord tax changes 2025, and tax efficiency for landlords to assess what’s best for your goals.

Tip 3: How to Plan Ahead for Capital Gains Tax (CGT)

Capital Gains Tax (CGT) happens when you sell or ‘dispose of’ a rental property for more than you paid. For individual landlords, CGT is a key consideration and what you owe can vary based on your total income and how your portfolio is structured.

Here are three ways to manage your capital gains tax property more effectively:

Know Your Rates & Allowance

In 2025/26, individuals have a CGT allowance of £3,000. Gains above this are taxed at 18% (basic rate taxpayers) or 24% (higher/additional rate). If your gain pushes your income into a higher band, you’ll pay the increased rate on that portion.

Offset Allowable Costs

You can deduct purchase and selling costs like estate agent and solicitor fees, plus major improvements (e.g. extensions or loft conversions) to reduce your gain. Regular maintenance costs aren’t deductible for CGT.

Understand Reliefs & Timing

If the property was ever your main residence, you may qualify for Private Residence Relief. Joint owners can each use their CGT allowance. Remember: CGT must be reported and paid within 60 days of completion.

Careful planning and good record-keeping can significantly reduce your CGT bill — and protect more of your profit when it’s time to sell.

Tip 4: When Does VAT Apply to Property Renovation and Construction?

VAT on property renovation can be a tricky area for property businesses, particularly when dealing with renovations, conversions, or new builds. While many construction services are standard-rated at 20%, there are important exceptions that could significantly affect your project costs.

The rules below only apply if you plan to sell the property. If you are going to rent the property only you can’t reclaim any VAT as rental income is generally exempt from VAT.

Here are three VAT tips to help you navigate the rules:

Know the Zero-Rated Opportunities

New builds for qualifying dwellings and certain buildings used by charities may be zero-rated when sold. Housing association conversions of non-residential buildings into homes or communal properties can also qualify for 0% VAT — a major cost saving on larger developments as you can reclaim VAT on development expenditure.

Take Advantage of the 5% Reduced Rate

Some projects, such as renovating empty homes, or changing residential use may qualify for a reduced 5% VAT rate when sold. Be sure to factor this in when budgeting, and confirm your contractor understands these rules as some the VAT you reclaim might also be at the reduced rate.

Getting VAT right can protect your margins and avoid surprises. Always consult your accountant before committing to major works or contracts.

Conclusion: Get Expert Tax Advice for Your Property Business

Tax can be one of the most complex parts of running a property business — but getting it right can bring huge benefits with the correct property business accounting. By understanding the difference between capital and revenue expenses, choosing the right ownership structure, planning for CGT, and being clear on when VAT applies, you’re already a step ahead of the curve.

But every property business is different. If you’re unsure how these rules apply to your situation, or you’re looking to make your property portfolio more tax-efficient, we’re here to help.

Collective Concepts Accounting specialises in property tax and landlord accounting — so whether you're letting out one flat or managing a portfolio, contact us to help you save time, reduce tax, and grow with confidence.

FAQs on Property Business Tax

What taxes apply to property businesses in the UK?

The main taxes affecting property businesses include

Income Tax or

Corporation Tax on rental profits,

Capital Gains Tax (CGT) on disposals, and

Stamp Duty Land Tax (SDLT) when purchasing property. You may also need to consider

VAT if you develop or manage commercial properties.

Can I claim expenses against my rental income?

Yes, you can deduct allowable expenses such as letting agent fees, repairs, insurance, mortgage interest (subject to restrictions), and accountancy costs. However, capital improvements - like extensions - must be added to the property’s cost basis instead of being deducted immediately.

Do limited companies pay less tax on property income?

It depends. A limited company pays

Corporation Tax at 25% (as of 2025) on profits, which can be more efficient for higher-rate taxpayers. However, you’ll also need to consider extraction costs, such as dividends, when deciding whether to incorporate.

How is Capital Gains Tax calculated when selling property?

CGT is charged on the gain between the sale price and the original purchase cost (plus allowable expenses like legal fees and improvements). Residential property usually attracts higher CGT rates than commercial property, and companies may instead pay Corporation Tax on gains.

Should property businesses register for VAT?

If you buy, sell, or lease commercial property, VAT may apply depending on whether the property is opted to tax. Residential lets are usually exempt, but it’s important to check each case carefully to avoid unexpected liabilities.

Can Collective Concepts Accounting help with property tax planning?

Yes, our team can help you structure your property business efficiently, claim all eligible deductions, and stay compliant with the latest HMRC rules - ensuring you protect your profits and plan effectively for growth.